Technological Impact of Digital Payment Systems on Consumer Behavior and Optimization of the Cash Flow Conversion Cycle in Pakistan

DOI:

https://doi.org/10.62019/zpq9m565Abstract

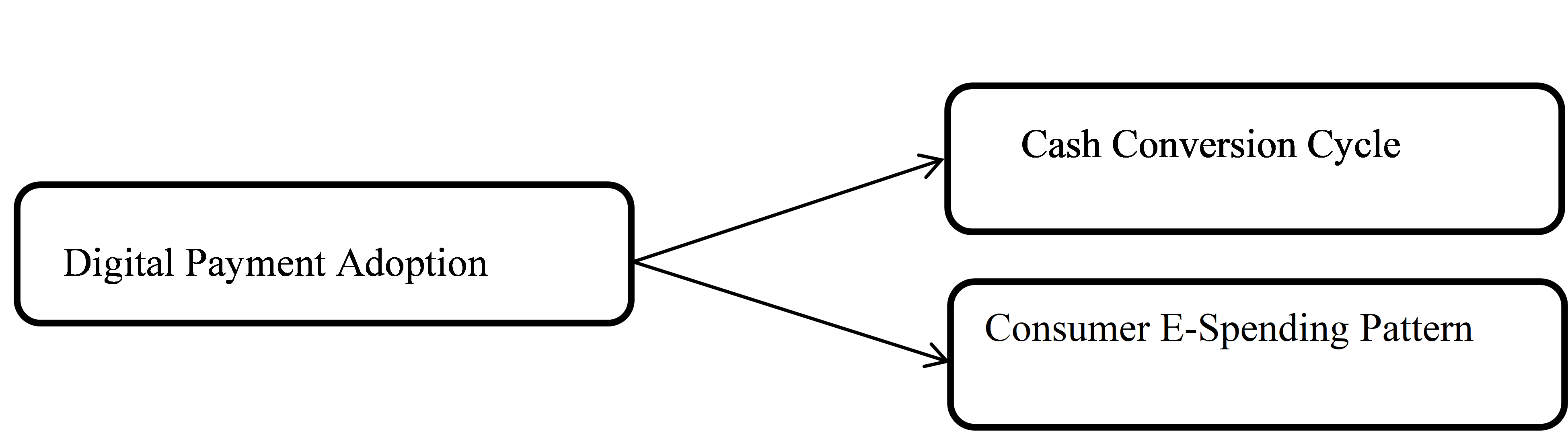

This study aims to investigate the impact of digital payment system technology on consumer behavior and cash flow optimization in the context of the developing markets specifically in Pakistan. This study opts for a quantitative research approach and examines how the acceptance of digital payments changes spending behaviors and increases financial efficiency for businesses. Based on the Technology Acceptance Model (TAM), this study pinpoints determinants like ease of use, perceived usefulness, and social influence as major drivers in consumer adoption. The study reveals that digital payment adoption results in reducing cash conversion cycles that allow businesses to operate more efficiently and influence consumer spending behavior by increasing the value and frequency of transactions. Digital payment systems maintain a growing path that enables both financial inclusion advancements and economic growth-enabling factors within developing economies despite challenges with infrastructure and digital competence. The study provides the essential groundwork for policy recommendations that target both financial practitioners and policymakers who seek the development of digital financial systems.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Farheen Abdul Rehman, Sohaib uz Zaman, Ali Asif, Khalida Shafi

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.