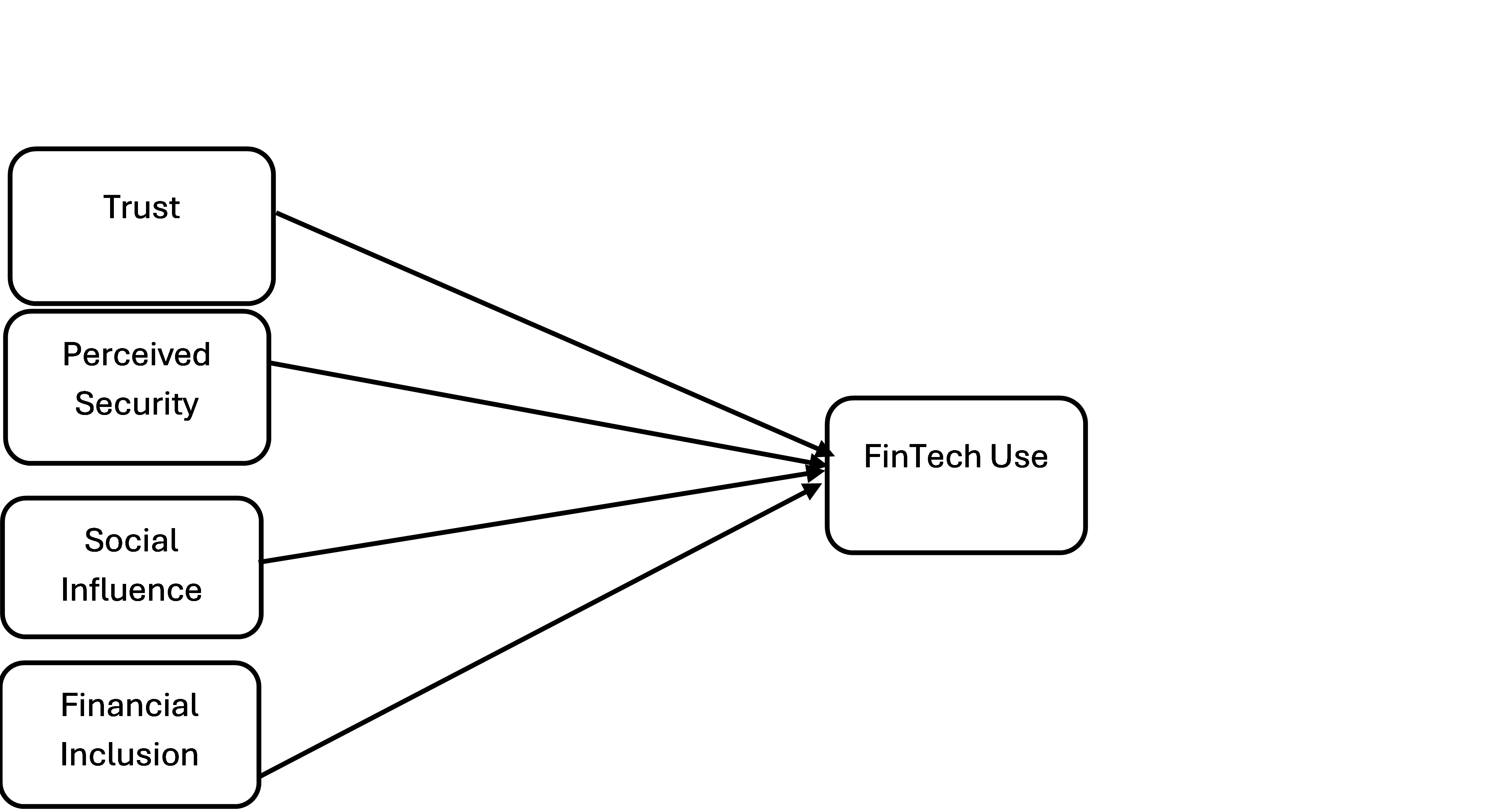

Fintech Adoption in Pakistan’s Banking Sector: The Nexus of Trust, Perceived Security, Social Influence and Financial Inclusion

DOI:

https://doi.org/10.62019/tdvbt207Abstract

This research tries to identify the banking sector of Fintech use: trust, perceived security, social influence, and financial inclusion. The structured questionnaire used for collecting data from 231 participants, including students, company employees, bank employees and the self-employed. This study applied Pearson correlation and multiple regression analysis for relationships between independent variables and Fintech use. The study used the software IBM SPSS for multiple regression analysis, which explained 78.5% of the variation in Fintech use. The linear regression analysis is applied, and the results show that social influence and financial inclusion have a strong and positive relationship with the Fintech Use. However, Trust and Perceived Security have positive trends but they are statistically insignificant in Fintech use. The findings indicate that Fintech providers ought to prioritize enhancing financial inclusion and leveraging social influence to boost fintech adoption. The findings indicate that strategies centered on social engagement and improved financial inclusion infrastructure could significantly augment the use of Fintech in Pakistan's banking sector.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Muhammad Rehan Khan , Muhammad Imran, Amna Tariq, Asghar Ali Arshad, Saalma Khalid Khalid

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.