Impact of Cash Holding on Firm Performance: Empirical Evidence from Pakistan

DOI:

https://doi.org/10.62019/abbdm.v3i1.250Keywords:

Cash Holdings, Firm Performance, Corporate PerformanceAbstract

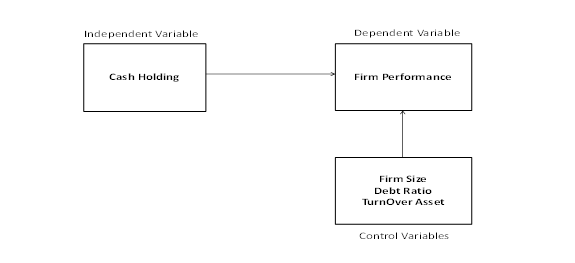

The study investigates the impact of cash holdings on firm performance, in the presences of firm size, debt ratio, and asset turnover. Using data from 91 firms over a six-year period (2017-2022), the study demonstrates the importance of cash reserves for boosting firm value and operating efficiency. The finding show a positive correlation between liquidity and business performance, emphasizing the strategic importance of cash management in corporate finance. This study, which examines key firm characteristics as well as cash holdings, gives insights into the intricate elements driving corporate success and valuable information for managers and policymakers trying to improve financial strategies for long-term growth.

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Sania Sarfraz Raja, Shahjahan Sarfraz Raja, Eman Zainab, Shahnawaz Sarfraz Raja

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.