The Impact of Working Capital Management on Firm Profitability amid Changes in Interest and Foreign Exchange Rates: A Case Study of Pakistan’s Cement Sector.

DOI:

https://doi.org/10.62019/gxpzda89Abstract

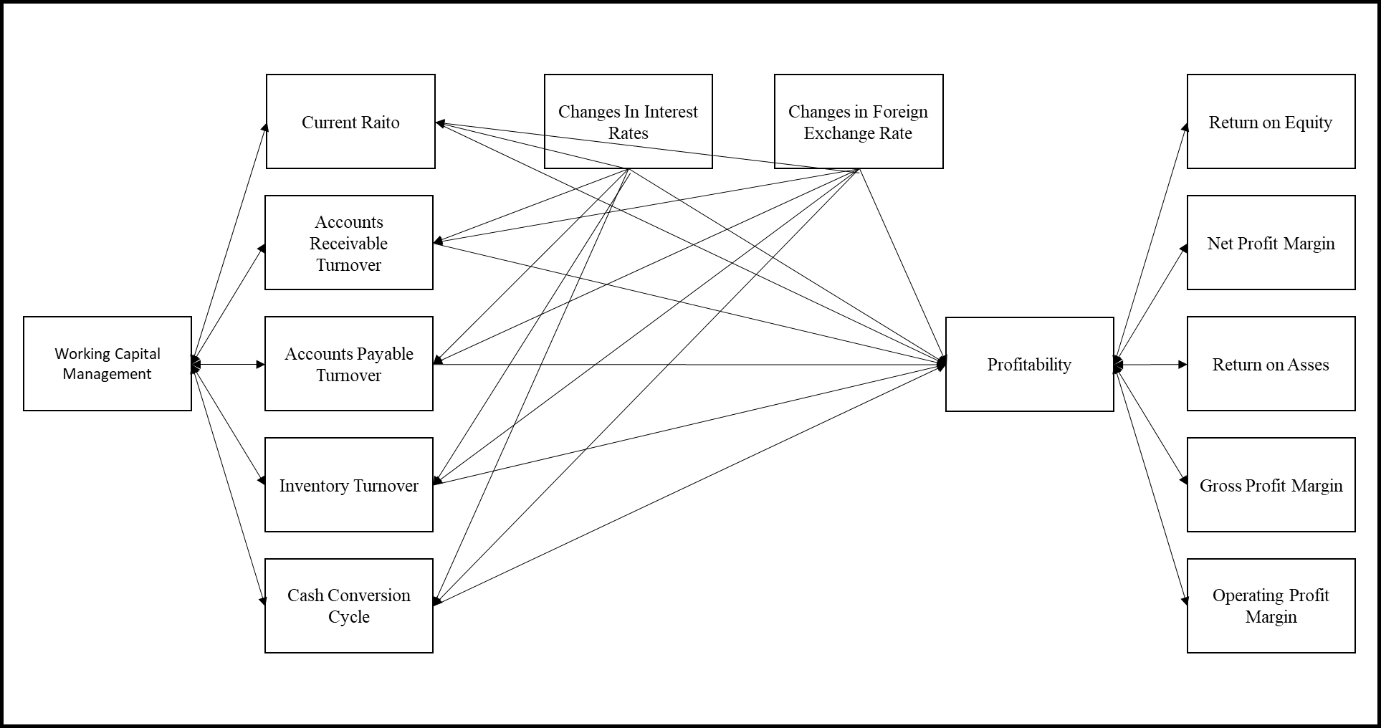

Working Capital Management (WCM) and its effect on the profitability of firms in the cement sector of Pakistan when interest and exchange rates are continuously fluctuating. This paper uses panel data from 16 PSX listed firms (2014–2023) to assess some key WCM components such as Current Ratio, Inventory Turnover, Accounts Receivable Turnover, Accounts Payable Turnover, and Cash Conversion Cycle while comparing it with profitability variables such as ROA, ROE, GPM, OPM, and NPM. Liquidity management plays a pivotal role in finding, whereas the macroeconomic factors moderate the WCM’s effect on profitability. Insights for financial managers and policymakers are provided for improving financial resilience in volatile economic conditions.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Muhammad Areeb Hasan, Sohaib-uz- zaman

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.