The Impact of Mutual Funds on Pakistan's Stock Market, Economy, and Investor Risk Diversification

DOI:

https://doi.org/10.62019/hmdha514Abstract

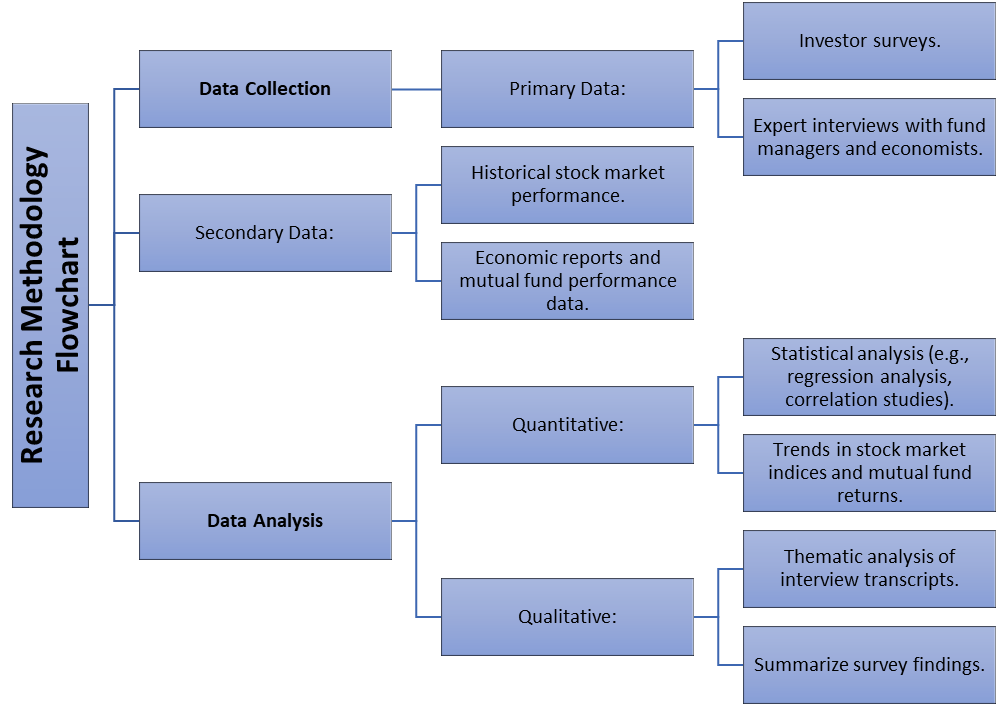

This research focuses on the effects of mutual funds on the stock exchange, Pakistan’s economic growth, and the diversification of investors’ risks. It is to investigate the impact of the mutual fund on stock return, growth and help the investors in managing their financial risks. The study adopts a quantitative research strategy; whereby descriptive statistics, hypothesis testing, and regression analysis have been used to analyse mutual funds and their coefficients. The data was obtained through administering structured questionnaires to the investors and the financial professionals in order to assess their perception on the role of mutual fund. The findings suggest that mutual funds have a significant influence in increasing the liquidity of the stock market and improving the economy. Among all these factors, market liquidity came out as the most dominant factor affecting the stock market performance, supporting literature review research conducted elsewhere. However, it was very difficult to fully ascertain the fact that mutual funds effectively help in reducing the volatility of the stock market. In the same way, there are the benefits of risk diversification but these do not explain the trends of stock market. Another limitation was the low investors’ awareness of mutual funds, and a lack of adequate financial literacy were other factors affecting the study.The results indicate recommendations for enhanced financial literacy, better financial regulation, and the availability of different types of mutual funds. To make mutual funds more effective and accessible, efforts must be made to increase investment in digital platforms and decrease the cost of transactions. Implementing the concept of mutual funds is essential for increasing variability in the financial market and for the development of the economy in Pakistan. Thus, measures to address these regulatory imperfections and the lack of awareness among the lower levels of the population are crucial to unlocking it. This suggests that future research should attempt to determine the effect of mutual fund investments on long-term financial stability.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Omer Bin Ahsan Shaikh, Sohaib-Uz- Zaman

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.