Real-Time Financial Fraud Detection: An Intelligent Data-Driven Framework Integrating Machine Learning, Stream Processing, and Big Data Analytics for High-Velocity Transaction Monitoring

DOI:

https://doi.org/10.62019/f3c0g313Abstract

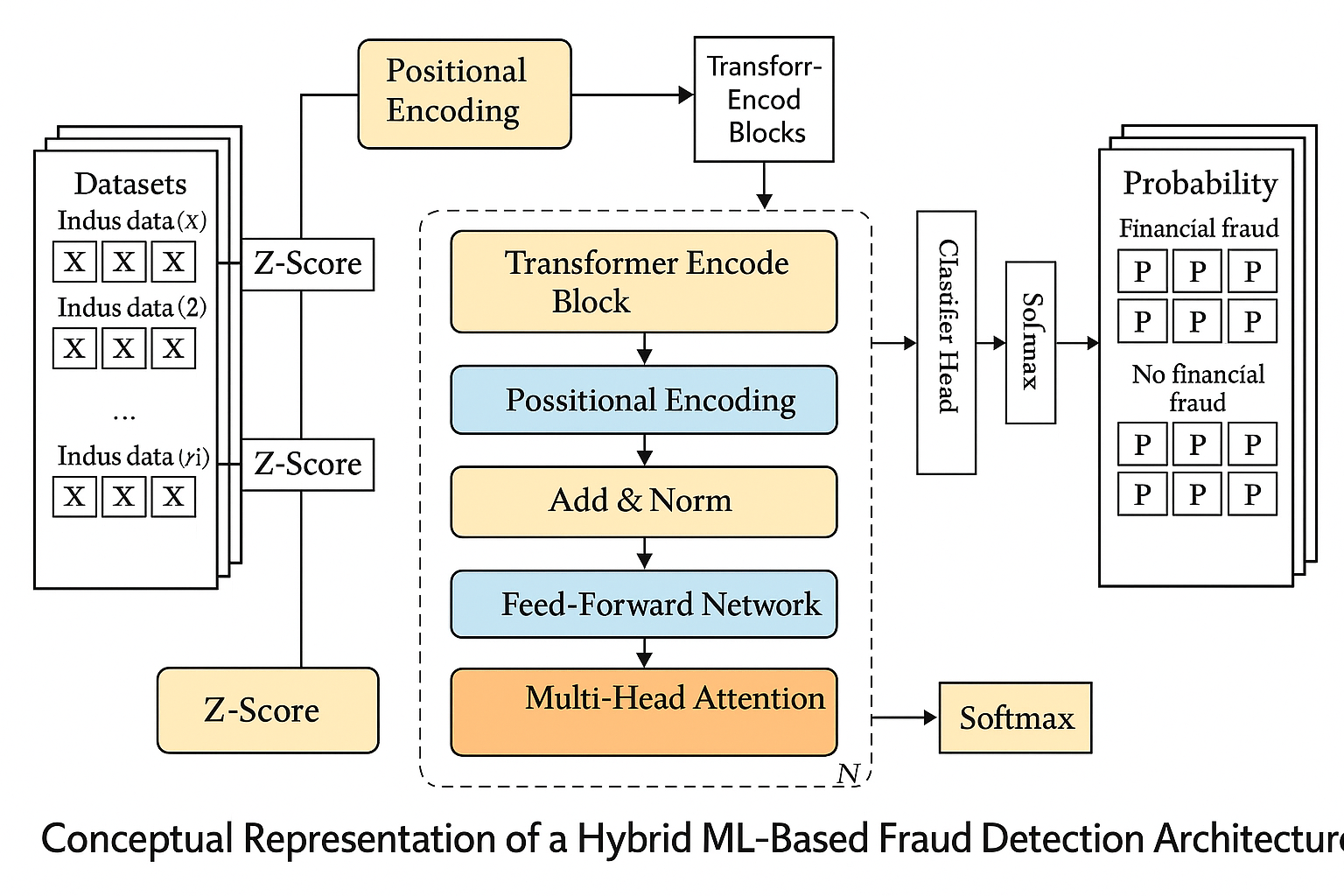

The exponential growth of online financial transactions has significantly increased the vulnerability of banking and e-commerce systems to fraudulent activities, demanding intelligent, adaptive, and real-time detection mechanisms. This study presents an intelligent data-driven framework integrating machine learning, stream processing, and big data analytics for high-velocity transaction monitoring. The proposed architecture harnesses distributed data ingestion pipelines and stream-oriented processing engines to capture and analyze massive, continuously generated financial data streams with minimal latency. Feature engineering modules are designed to extract transactional, behavioral, and temporal features from heterogeneous data sources, while big data technologies such as Apache Spark and Kafka enable scalable real-time data handling. At the analytical core, the framework employs a hybrid ensemble of supervised and unsupervised learning models Random Forest (RF), Gradient Boosting (GBM), and Autoencoders to achieve robust detection of both known and novel fraud patterns. The models are trained on large-scale transactional datasets using feature selection and hyperparameter optimization strategies to ensure accuracy, interpretability, and generalization across dynamic environments. Streaming analytics and online learning components allow continuous model adaptation to evolving fraudulent behaviors without retraining from scratch. Experimental evaluations conducted on benchmark and synthetic datasets demonstrate the superior performance of the proposed framework in terms of detection rate, false-positive reduction, and computational efficiency compared with conventional batch-learning systems. The system achieves real-time throughput exceeding 50,000 transactions per second with sub-second decision latency, illustrating its suitability for deployment in large-scale financial ecosystems. In addition, explainable AI (XAI) modules are integrated to interpret model predictions and provide transparency in decision-making, thereby facilitating regulatory compliance and user trust. This research contributes to the ongoing advancement of intelligent financial security systems by merging data-driven learning with scalable stream analytics. The proposed framework offers a practical and generalizable solution for banks, payment gateways, and fintech platforms to identify fraudulent transactions proactively and adaptively in dynamic, high-velocity data environments. Future work will focus on integrating blockchain-based audit trails and federated learning for enhanced privacy and cross-institutional fraud intelligence sharing.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Farah Arzu, Muhammad Khurram Zahur Bajwa , Obaidullah, Abdul Waheed, Farooq Alam, Muhammad Ali, Ajab Khan

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.